Parenting kids in their late teens and early 20s can be difficult. They aren't children any longer, but they might still be living at home or partially dependent on you. They still often need guidance and help with various issues, including finances. Yet it can be a tricky balance to grant them the independence that they want and need while also providing the help that is necessary. The tips below can help you do that.

Budgeting

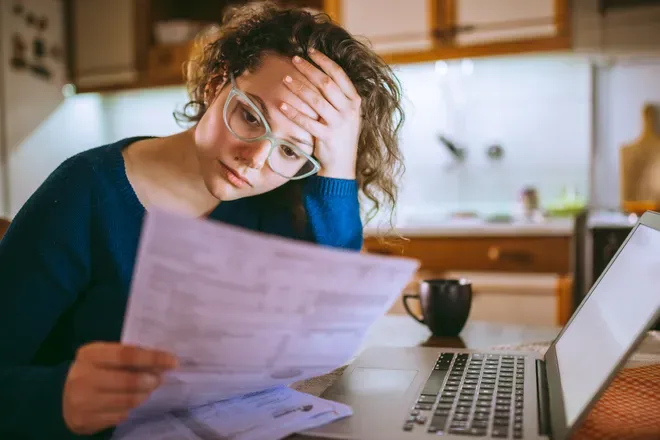

Whether your kid is living at home, going to college, or moving out on their own, you might want to give them a hand with making a budget. It can be difficult to learn how to juggle the cost of necessities along with things like clothes and entertainment in those first early years, and it's the reason many young people may end up with a substantial amount of consumer debt. By talking to them about budgeting and helping them getting into the habit of tracking their spending, you can help them avoid falling into debt before they've really gotten their financial life started.

Help with College

Your kid could use a lot of help with various aspects of finances during college, including budgeting. Your child may also get their first credit card at this time, and talking to them about compound interest and the dangers of falling into debt can help them use it responsibly. How to cover tuition and other costs is a big concern for many students and their parents. College is so expensive that people often turn to multiple sources for funding.

Among the options are savings, student loans, grants, and scholarships. As a parent, you may also want to look to other ways to fund their education. If you own your own home, you might want to consider a home equity line of credit. A HELOC allows you to borrow against your home as collateral, and unlike a traditional loan, you can borrow multiple times. This can be an excellent option to cover or supplement the costs of college and can help reduce or eliminate the student loan debt they might otherwise have to carry.

Retirement Savings

When your child is 18 or 19 years old or even in their early 20s, retirement can seem so far off that it might as well be something that will never happen. For this reason, if they can contribute to a retirement account, they might instead opt for the bigger paycheck. You can do them a big favor by showing them how that money they contribute during these years will grow substantially, even in more safe and conservative investments, over the many decades between the present and retirement thanks to compound interest. Furthermore, if they start now, they will be able to comfortably contribute less as they get older and have more financial obligations. You can sit down and do some math to demonstrate this to them.

Buying a Home

Another big way that parents can help children is with the down payment on a home. Even with 40 year mortgage lenders allowing your mortgage to extend beyond the traditional 15 or 30-year periods, it can be tough for a young person to come up with the down payment needed to get a reasonable mortgage rate. Helping with this can make a real difference in their ability to get on the property ladder. In some areas, monthly mortgage payments are less than rent, so they will also save money in that way. Providing a down payment is a great way to offer practical support that results in giving them greater autonomy, independence, and responsibility as they take on home ownership.

Withdrawing Support

Not every kind of financial help is good for your adult child. While it can be important to provide them with a safety net, if they have become dependent on regular injections of cash from you or assume that you'll always be there to bail them out from their bad financial decisions, you may not be doing them any favors. You shouldn't cut them off overnight, but working with them to gradually remove your support and allow them to become independent is the best way to make sure they have the knowledge and resilience about financial matters that they will need for success over the long term.