Is it possible to find an apartment if you have bad credit history? Definitely! However, hunting for a rental apartment for immediate move-in is nerve-racking for a person with a low credit score.

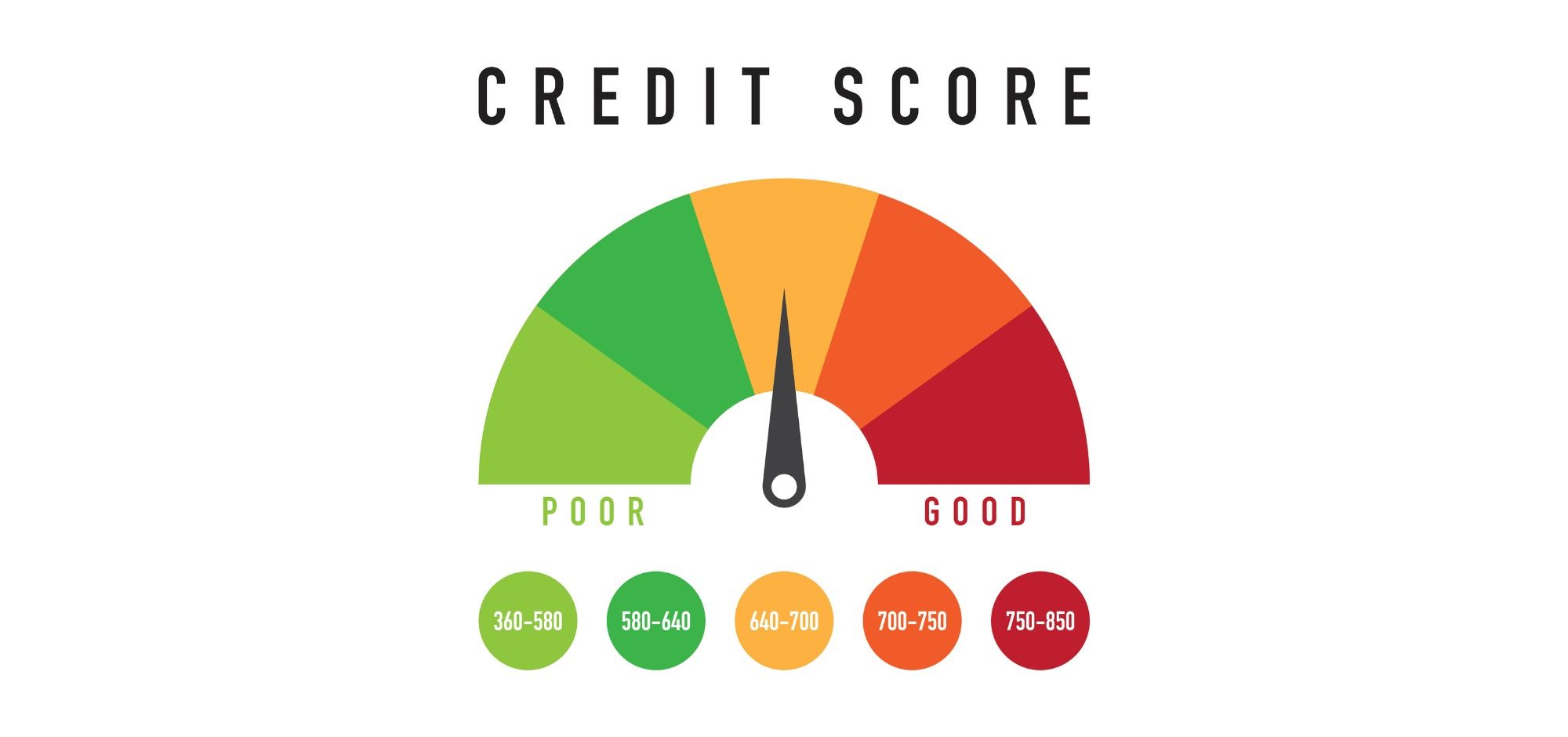

Credit checks are the foremost priority for landlords - whether the landlord is a corporate entity or a mom-and-pop investor. A credit check is the primary part of the tenant screening process, where the landlords check if the renter has a stable credit history of paying rent on time and also paying other bills, such as credit cards or auto loan payments.

What are No Credit Check Apartments?

As the name suggests, a no-credit-check apartment is an apartment rental program without the obligation of having a strong credit history. Instead, other sources are used to determine whether the tenant can make timely rental payments.

No credit check apartments are rare to find in low inventory rental markets. However, rental needs with low competition do not usually require credit checks.

If you lack a credit history or are struggling with bad credit rentals, you need to stop worrying. Where finding a low-credit or no-credit-check apartment is difficult, it’s not impossible.

Here is a list of places to begin your search:

Apartments with No Credit Check

If you have bad credit, you can try these tips to help you find apartments near you.

Since searching for no-credit-check apartments includes additional effort and time, you'll need to get creative when shopping for the right property. Here are some great places to look, that may not require a credit check at all:

1) Long-term Airbnb properties

Long term Airbnb properties can be houses, apartments, condo rentals or even unique stays like cabins or beach houses. Many Airbnb owners offer long-term rentals for a month or up to 12 months. The only downside might be the cost versus a traditional apartment, but you may still find a good deal.

2) Craigslist

Craigslist offers hundreds of listings, but just be careful because the site also has scammers that lurk the platform.

3) Small, non-corporate apartment buildings

Smaller apartment communities often have more lenient standards. You might deal with a property manager or directly with the owner, unlike with larger developments that are operated by a corporation.

4) Local newspaper

Yes, there many landlords still advertise through local newspapers, so it's worth checking!

5) Roommate finder websites

If you don't want to have your name on the lease, this might be a solid option. Rooming with a stranger may be a good option if you're new to city.

6) For-Rent-By-Owner houses

By owner properties can often be found on Zillow. A common example is a property owner that wants to rent their home. The homeowner may want to pay property manager fees, so the homeowner lists the property on their own through a site like Zillow.

7) Facebook groups

Local Facebook groups are very similar to what you might find on Craigslist but still worth checking. Just search for apartment rentals in your local Facebook group or the Facebook Marketplace.

8) Short term rentals

Looking into short term rentals is particularly sensible if you want to rent either a room or an entire apartment without having your credit history scrutinized. And if you find temporary accommodation through a reputable listings site, then it’s easier to make inquiries with confidence. The cost of a short term rental may be higher than if you sign up for a longer contract, but this is offset by the benefits of not requiring a credit check.

9) Apartment websites and apps

It's not a bad idea to shop on the larger apartment rental websites and apps. You can often find unique offerings and a bigger selection of properties.

Ways to Find a No Credit Check Apartment

When looking for low-credit apartments near you, keep these factors below in mind. Let’s dive into the ways to find no-credit-check apartments.

Get a Strong Guarantor/Consignor Support

Renting an apartment with bad credit rentals is undoubtedly possible with the help of strong consignor support. Usually, tenants get help from their family members or relatives who can guarantee rental payments.

It is, however, essential for the guarantor to qualify for some basic requirements–a stable credit history or annual income equivalent to a minimum of 80 times the monthly rent. In this case, the guarantor is responsible for any rental payments missed by the tenant. This becomes even more important for luxury properties, condo rentals or communities with strict rental regulations.

Provide solid income proof

Owners need to check the credibility of the renter during the screening process. Another way to make your case strong is by providing your income and savings proof to the landlord.

Their right is to inquire about your bank statements to understand how you would manage rental payments during uncertain financial distress.

Offering Immediate Move-In

Just like we confirm our seats for admission to a college/university, similarly, you can offer to move in as soon as possible and secure your apartment.

This significantly reduces the apartment vacancy rate, and your case becomes stronger than other potential tenants. Whether you move into the apartment physically or not, the advance payment does the job well.

Offer Employer’s Reference

Another way to strengthen your screening process is by providing your employer’s reference. Getting referred by your employer as a competent employee would be a cherry on top of your application.

This acts as security at the landlord’s end–the provided reference can be contacted upon need.

Deposit a Significant Amount in Advance as Security

Some tenants bolster their rental application by offering a huge amount in advance as a security deposit.

Offer the Full Year Lease in Cash

This is a creative option, if you have a lot of cash laying around. But be aware that while it may sound like a no-brainer for the renter, it may raise a red flag to some landlords.

Conclusion

An apartment search can be stressful. But, having bad credit or no credit doesn't make it impossible to rent a property. Once you're in your next apartment, begin planning ways to improve your credit score for the next time you need to move.