Please note: This is not financial advice and SimpleShowing does not endorse or promote any specific cryptocurrencies. In general, we encourage a versatile asset mix including real estate and equities. Crypto investing may not be a wise investment strategy for all of our readers.

Despite a downturn in token prices beginning in mid-2022, crypto remains a popular investment opportunity globally. As adoption continues to grow among institutional investors like Fidelity, Nasdaq and Citi, token prices are expected to increase in the future.

There are surprisingly more than 10,000 alt-coins, but less than a couple hundred that have tangible developer and ecosystem support.

What makes a token a promising investment?

Adoption from the software developer community dictates the survival of a token and what type of DeFi applications are built on the related chain or protocol. If there is limited developer interest or support, the token is unlikely to sustain much growth or adoption.

Another factor that influences a token's success is the availability of purchase. For example, getting listed on a major exchange such as FTX, Coinbase or Robinhood will expose the token to a much larger investor audience. Without a major exchange, most tokens are purchased, sold or swapped on apps like SushiSwap with a hot wallet, such as Metamask. Many retail investors do not have a hot wallet and rely on large exchanges to "custody" their tokens, simply as a convenience.

Top 10 crypto tokens

1) Ethereum (ETH)

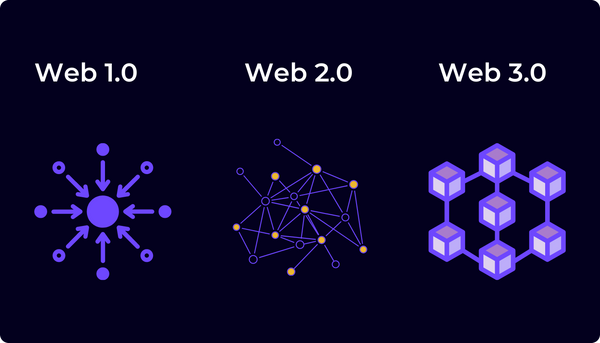

Ethereum is perhaps the most popular protocol for building apps and organizations in a decentralized and permissionless way. Ether (ETH) is the native cryptocurrency of Ethereum.

Ethereum DeFi app support exploded in 2018 and the protocol is the most widely used for building "smart contracts" that execute on-chain transactions. Ethereum token price growth went from about $10 to around $1,500 over a 2 year span, increasing around 13,000%.

2) Bitcoin (BTC)

Bitcoin is easily the most popular decentralized digital currency in existence. Bitcoin’s was created by Satoshi Nakamoto, who described the need for “an electronic payment system based on cryptographic proof instead of trust.” Bitcoin has a massive market capitalization and after a long bull run in 2021, when the price of one BTC reached $68,000.

Despite a price drawdown since 2021, Bitcoin is widely viewed as an alternative investment for portfolio diversification because the price over time has been less susceptible to dramatic price swings. Many corporations now accept Bitcoin as a method of payment - such as Starbucks, PayPal and Whole Foods.

3) Solana (SOL)

Solana was developed to support the shift from traditional banking/finance applications to decentralized finance (DeFi) use cases. Solana runs on a unique hybrid proof-of-stake consensus algorithm and SOL, Solana’s native token, powers the platform.

Solana's origins date back to late 2017 when founder Anatoly Yakovenko published a whitepaper draft detailing a new timekeeping technique for distributed systems called Proof of History (PoH). Solana launched on Mainnet Beta in March 2020, shortly after raising $1.76 million in a public token auction hosted on CoinList.

4) Polygon (MATIC)

Polygon is an Ethereum token that aims to provide faster and cheaper transactions on Ethereum using Layer 2 sidechains, which are blockchains that run alongside the Ethereum main chain. Users can deposit Ethereum tokens to a Polygon smart contract, interact with them and then later withdraw them back to the Ethereum chain.

5) Polkadot (DOT)

Polkadot was created by Dr. Gavin Wood, who is one of the co-founders of Ethereum and the inventor of the Solidity smart contract language. Polkadot is designed to operate two types of blockchains: a relay chain, where transactions are permanent, and user-created networks, called parachains.

Polkadot has raised roughly $200 million from investors, making it one of the most well-funded blockchain projects in existence.

6) Cosmos (ATOM)

Cosmos is based on the consensus protocol, Tendermint, which was created by Jae Kwon in 2014.

Cosmos' technology is based on the Inter-Blockchain Communication protocol (IBC) - a system that allows different blockchains to connect and communicate with each other. By allowing many different blockchains to interoperate, many different types of blockchain protocols can coexist to serve their own unique use cases, without fear of competition, vulnerabilities or cyber-hacks.

7) Avalanche (AVAX)

Avalanche is a blockchain platform that offers tools for launching DeFi applications and institutional-grade financial solutions. Avalanche enables processing of over 4,500 transactions per second, which is significantly faster than that of Bitcoin or Ethereum (pre-merge).

AVAX reached its highest-ever price of $144.96 in November 2021. The spike occurred after an announcement that it was partnering with global accounting firm Deloitte to “build more efficient disaster relief platforms using the Avalanche blockchain.”

8) Fantom (FTM)

Founded in 2018, Fantom is a Layer 1 smart-contracting platform that delivers cheap, rapid, and secure transactional capacities to users and developers. In 2019, Fantom announced that it would partner with Binance to improve interoperability by creating a multi-asset and cross-chain ecosystem.

Similar to Avalanche, Fantom is also compatible with the EVM (Ethereum Virtual Machine), meaning that developers can easily move their projects from Fantom over to Ethereum, which is attractive to engineers building on the protocol.

9) Cardano (ADA)

Founded in 2015 by Ethereum co-founder Charles Hoskinson, the development of the Cardano is overseen by the Cardano Foundation, which is based in Switzerland. Cardano is an open-source protocol originating from peer-reviewed academic research and is viewed as a “third-generation” protocol that improves upon on perceived technical limitations of Bitcoin and Ethereum.

10) Compound (COMP)

Compound Labs was founded in August 2017 by Geoffrey Hayes and Robert Leshner, who subsequently published a whitepaper for the Compound protocol and token.

Compound allows users to deposit crypto into lending pools for access by borrowers. Lenders can earn interest on the assets that they deposit. Compound uses multiple crypto assets to provide this service, enabling the lending without a traditional intermediary, like a bank.